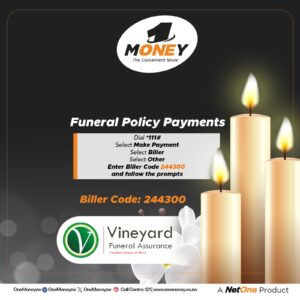

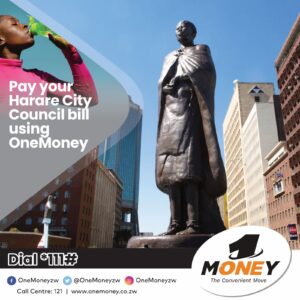

Zimbabwe’s giant Mobile Network Operator (MNO) NetOne’s OneMoney, a mobile payment service that allows users to send and receive money, pay bills, and buy airtime has revolutionized financial inclusion.OneMoney is offered by NetOne and is available on Android, iOS, and feature phones.

In a just released statement NetOne through OneMoney stated, “Revolutionizing Financial Inclusion: The Power of OneMoney

In today’s fast-paced digital world, financial inclusion is more than just a buzzword—it’s a necessity. As Zimbabwe continues to embrace digital financial solutions, OneMoney, the mobile financial services arm of NetOne, is proving to be a game-changer. With a robust distribution network  backed by the strength of NetOne, OneMoney is setting new standards in financial convenience, accessibility, and innovation.”

backed by the strength of NetOne, OneMoney is setting new standards in financial convenience, accessibility, and innovation.”

OneMoney added that,

“The newly upgraded OneMoney app is a testament to this commitment, designed to enhance user experience and streamline financial transactions like never before. With features tailored to meet the evolving needs of its users, OneMoney is not just an alternative—it is the preferred choice for mobile financial services in Zimbabwe.”

The Mobile Network operator went on to rhetorically categorically ask clients and invite them to their financial inclusion revolution.

“Why OneMoney?

Financial inclusion hinges on accessibility, security, and reliability—three pillars that define OneMoney’s service offering. Leveraging NetOne’s vast distribution network, OneMoney ensures that users, whether in urban centres or remote rural areas, have seamless access to mobile financial services. Unlike many other platforms, OneMoney is deeply embedded in communities, offering localized support and unparalleled coverage across Zimbabwe.

The app’s latest upgrade introduces several key features designed to revolutionize how users manage their finances:

• Invite Friends: Seamlessly expand your financial network by inviting friends via WhatsApp, SMS, or email.

• Statement Inquiry: View, download, and share transaction histories with just a few taps, ensuring transparency and ease of access.

• No-PIN Payments: Make small transactions quickly and securely without the need for a PIN.

• QR Code Payments: Enjoy the convenience of receiving payments instantly through QR codes.

A Vision for the Future

Speaking on the latest advancements, OneMoney Managing Director Mr. Joseph Machiva highlighted the company’s relentless pursuit of innovation. “OneMoney is more than just a mobile wallet; it’s a financial empowerment tool. Our goal is to bridge the gap between traditional banking and digital finance, ensuring that every Zimbabwean has access to secure, seamless, and efficient financial services.”

NetOne Group Chief Executive Officer, Engineer Raphael Mushanawani, reinforced this vision, emphasizing OneMoney’s role in driving financial inclusion. “The strength of OneMoney lies in the strength of NetOne—our extensive distribution network, our commitment to technological advancement, and our ability to serve communities at every level. The latest upgrade is a significant step towards a future where financial services are truly accessible to all.”

The Future is OneMoney

With the upgraded OneMoney app now available on both Google Play Store and Apple App Store, users can experience firsthand the efficiency and security that define the platform. Whether paying bills, purchasing airtime, or sending money, OneMoney ensures that financial transactions are effortless and secure.”

OneMoney’s evolution is far from over. As financial technology advances, so too will OneMoney, ensuring that Zimbabwe remains at the forefront of digital finance. With NetOne’s unparalleled infrastructure and commitment to innovation, OneMoney is not just an option—it’s the future of financial inclusion in Zimbabwe.

Comments