Minister of ICT, Postal and Courier Services, Hon. Tatenda Mavetera, has a huge burden on her shoulders to alleviate the sector’s significant taxes and propel it forward towards better profitability and ease of doing business.

Within her 2-year-old career as the ICT minister, Mavetera has been successfully driving a plethora of policy issues very well. Still, the burden of taxation under her government is a real task and a test, which, if she turns this around during her tenure, the sector will remember her for the tenacity to take the bull by its horns.

The elephant in room has been huge taxation against the ICT sector, infact this is the only heavily taxed sector to an extent that one may think that the government is punitive against the service providers and the major reason why Zimbabwean data access has been way higher and less profitable compared to other regional countries.

By Toneo Toneo

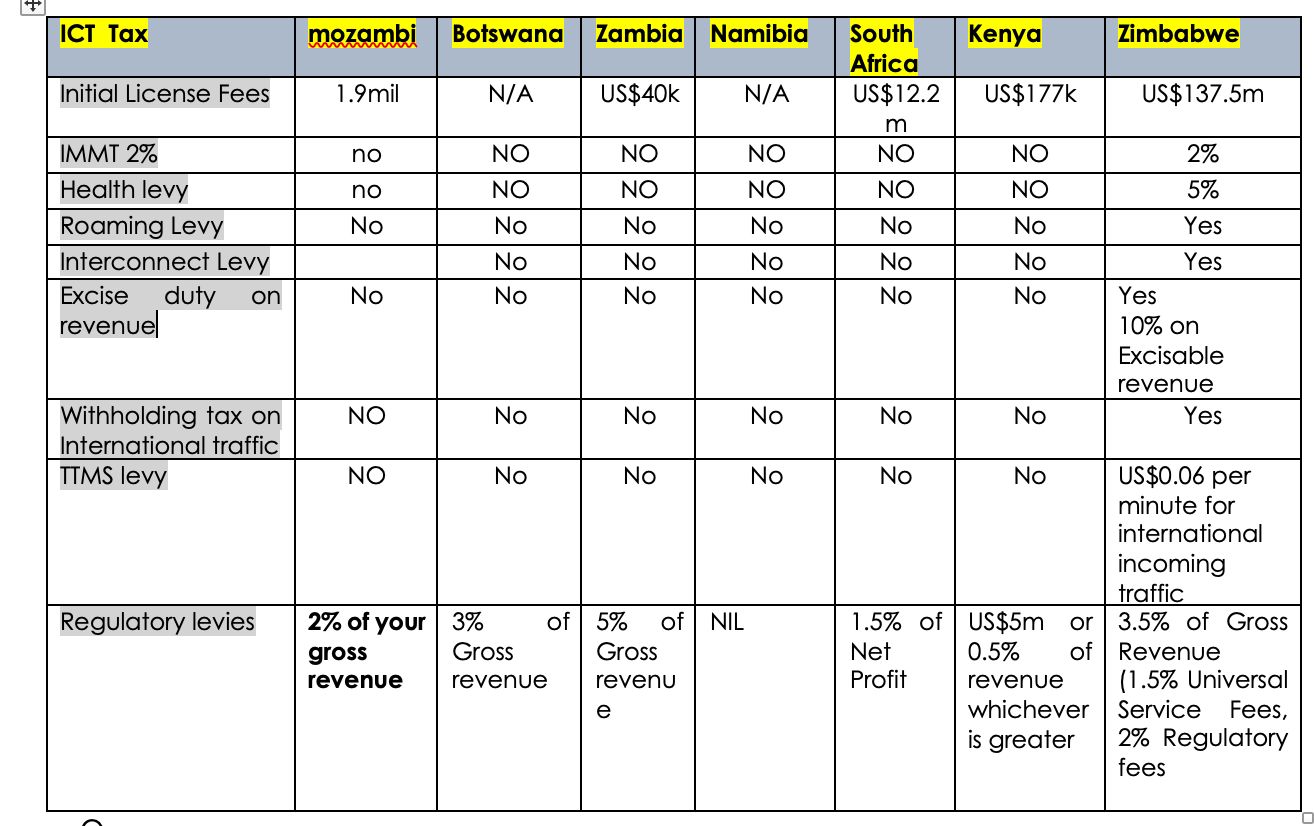

Besides the traditional $137.5 million operational license for 20 years, which is paid as a lump sum or across the period, ICT players in Zimbabwe also face serious taxation and regulatory fees to remain operational in Zimbabwe.

A total of 37 cents in revenue against every dollar made is deducted, directly to treasury, meaning the operators are only looking into the margin of the 63cents before profit, creating a huge burden, against ease of doing business to the telcos.

Trouble started when the minister of finance in 2017 tested the waters and introduced a health fund levy of 5% levy on all mobile phone airtime and mobile broadband, which was just a tax against mobile network operators.

To date, the minister of finance has not been transparent in telling us how much was collected so far and to what cause this fund has really contributed. All we know it’s going down towards the consolidated revenue fund, and no national feedback, even to the contributors themselves.

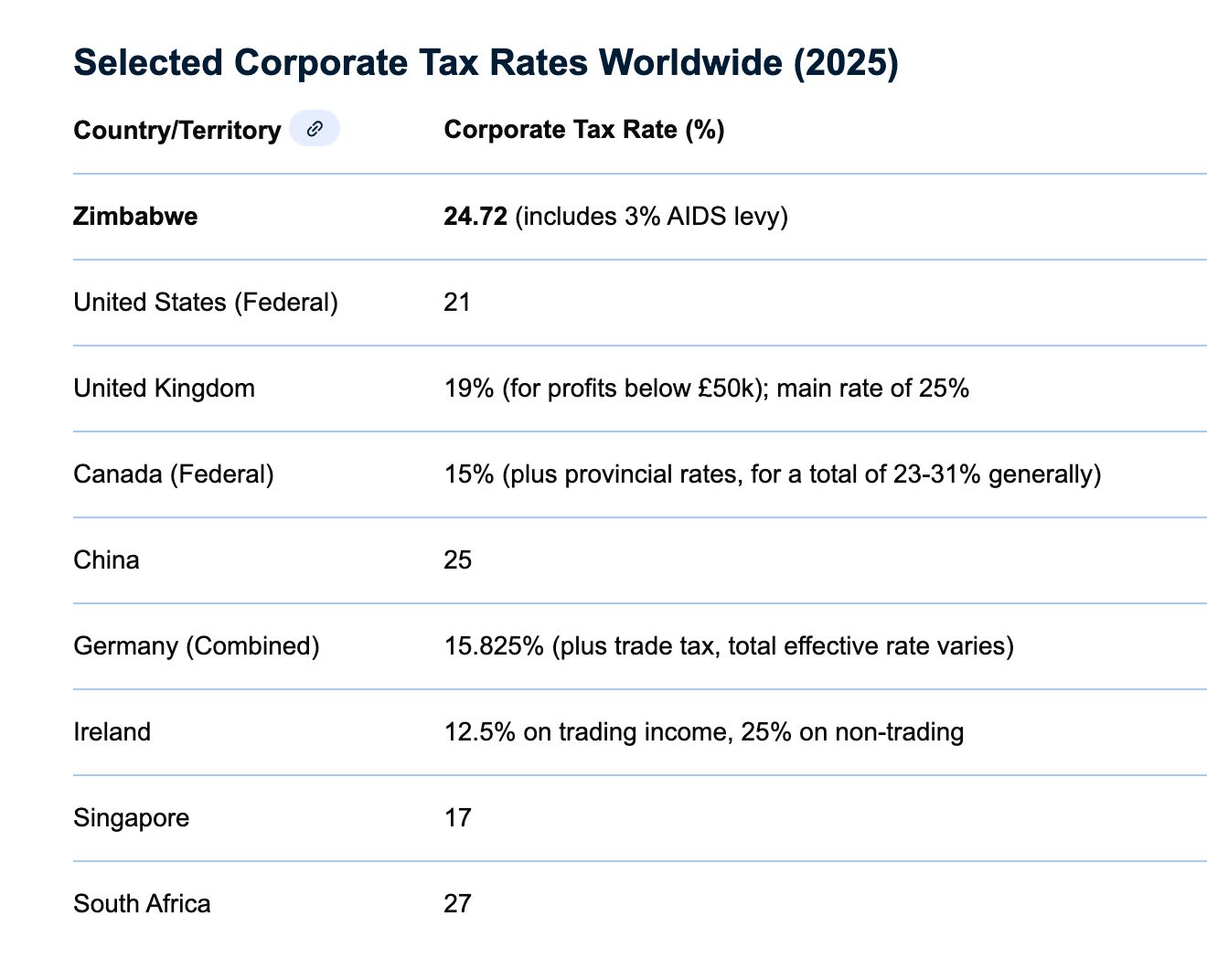

The AIDS Levy, a 3% tax on income tax (PAYE) for employees and on company profits, collected by ZIMRA and managed by the National AIDS Council (NAC) to fund national HIV/AIDS programs, primarily for antiretrovirals, prevention, and support, aiming to reduce reliance on foreign aid. It’s a key domestic resource, but it faces challenges like insufficient funding and transparency concerns

However, there was another rather ridiculous tax again introduced against the sector, which is called the 5% special excise duty. Traditionally, this tax must be deducted from individuals who are changing motor vehicle ownership, but this one is somehow a rather mysterious tax, given a random name, and yes, all the ICT players are being charged this tax against their revenue.

However, a 25% Corporate tax, across all companies, including ICTs as well included is levied by Zimra on the net income is standard, and another 15% VAT, although this is redeemable. This also has a mandatory Intermediated Money Transfer Tax (IMTT): A 2 % tax is levied on US dollar transactions and outbound foreign currency payments, with a flat cap for large transactions. The latest budget, however, reduced this to 1.5% only for Zig transactions.

The IMTT tax is collected at 2% per transaction and is not tax-deductible. IMTT is a consumption tax and not a tax on income, and by its nature should be allowed as a tax deduction in the same manner as other consumption taxes, such as customs duties.

Mobile network operators in Zimbabwe are also taxed with withholding tax on International traffic, which is charged for every international call terminating.

Another sector-specific cost that of roaming levy, which is a cost only Zimbabwe operators face across SADC for attracting revenue from roaming. When you travel abroad, your home network partners with a local foreign network to provide you with service. Your provider is charged for using this foreign infrastructure, and these costs are passed on to you, the consumer, as roaming charges; however, the service provider is charged by Potraz if it’s the one making the revenue.

After being charged a 20-year license fee for MNOs and also for ISPs, Potraz also charges operators a 3.5% of Gross Revenue, this is before even removing operating expenses.

Another separate 2% Regulatory fees, which is an annual licence fee of 2% (two percent) of the audited annual gross turnover payable monthly as prescribed.

From the regulatory licence fees operators are charged Universal Service Fund USF and License fees, 3.5% of their revenue, this is a fee that has been well developed by Potraz to further enhance the network for rural areas and places where predominantly MNOs have no business case.

A Telecommunication Traffic Monitoring System (TTMS) levy is also charged for the system they maintain to monitor traffic across all operators, this is likely for huge licence fees and costs associated with the procurement of the TTMS

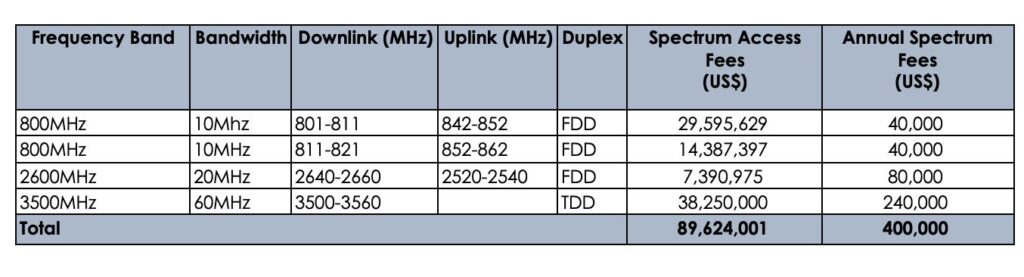

For Internet service Providers and Mobile network operators to have spectrum and operate within the provided frequency, they are charged

a) Number fees: Where applicable, the Licensee shall pay an annual number usage fee, in advance, at the rate prescribed by the Authority from time to time, as appropriate.

b) Radio frequency spectrum fees, where applicable, the Licensee shall pay an annual frequency usage fee, in advance, at the rate prescribed by the Authority from time to time, as appropriate.

c)VSAT terminal Fees Where applicable, the Licensee shall pay VSAT terminal fees, in advance, at the rate prescribed by the Authority from time to time.

Exporters’ Foreign Currency Retention Customers are required to sell to the Reserve Bank the statutory surrender portion currently at 30% of foreign earnings, meaning they only keep their 70% and the rest is kept at the Zig bank rate value.

Like any other business, the ICT sector is charged VAT, which can be recovered at the returns value, but there is non non-recoverable of was 5% excise duty or airtime, and then there was another 5% that was introduced called the special health levy.

To add to the burden on operators, they recently had an Increase in Withholding Tax on Local Tenders from the current 10% to a punitive 30%. This effectively pushes out small local players from suppliers

In his latest 2026 budget, Finance Minister Mthuli Ncube introduced a new tax again against the sector, the new 15% Digital Services Taxes DST was announced in the 2026 National Budget to ensure foreign digital platforms contribute to the local economy and level the playing field with domestic companies, which are fully taxed.

These players will simply pass on the tax burden to the users.

Various experts during the recently held TechnoMag’s Tech Convergence Fora, all bemoaned the huge taxation and levy costs, praying that the government, specifically the Ministry of Finance and Potraz, must review these inhibitive costs

Zimbabwe ICT players, both MNOs and ISPs will not competitively compete with the region when its players are the only ones being burdened by these various punitive costs, which clearly go against the government’s mantra of driving towards ease of doing business.

Effectively, this is reducing operators’ profits and cutting down on government taxes, hence self-defeating as well.

The biggest winner must be the consumer, when taxes and levies are reduced, the consumers benefit the most as they enjoy the services, hence driving the economy, increasing the GDP, and transforming the socio-economic environment.

Comments