The Reserve Bank of Zimbabwe has kept all key policy rates unchanged, with the bank’s Monetary Policy Committee looking to entrench significant gains achieved on inflation, domestic currency stability and the foreign exchange market discipline.

Announcing the resolutions, RBZ Governor Dr John Dr Mushayavanhu said the committee agreed to maintain the current tight monetary policy stance to consolidate gains achieved since late 2024.

Official statistics show that the monthly ZiG inflation has averaged 0,5 percent from February to September 2025.

Notably, the month-on-month ZiG inflation has remained largely anchored below 1 percent, declining from 0,4 percent in August 2025 to minus 0,25 percent in September 2025.

The annual ZiG inflation rate dropped from 82,7 percent in September to 19 percent in November, a trend Dr Mushayavanhu attributed to strict monetary discipline since September 2024.

“The MPC has resolved to ‘stay the course’ of the current monetary policy stance,” he said, adding that the central bank will maintain the bank policy rate at 35 percent and keep statutory reserve requirements at 15 percent for savings and time deposits, and 30 percent for demand and call deposits across all currencies.

Bank policy rates and statutory reserve thresholds are crucial tools used by central banks to manage liquidity in the financial system and control inflation by influencing the overall money supply, borrowing costs, and economic activity.

Inflation developments were central to the MPC’s decision, with the committee noting a significant slowdown in the annual ZiG inflation rate, from 82,7 percent in September to 19 percent in November.

Dr Mushayavanhu said the disinflation trend was a direct result of disciplined monetary management maintained since September 2024.

“The MPC welcomed the positive developments on the inflation front. Annual inflation is expected to continue declining further, ending the year 2025 at 15–17 percent,” he said.

The Governor added that for the first time in over two decades, the local currency inflation was projected to reach single-digit levels in the first quarter of 2026.

Analysts say this sets the stage for key policy rates normalisation in 2026, but the bank insists that stability must first be fully entrenched before easing.

Economist Mr Tinevimbo Shava said the MPC’s decision to keep rates unchanged was expected and sensible, given the central bank’s priority to consolidate the current disinflation momentum.

“This is the clearest signal yet that the RBZ wants to avoid any premature loosening,” he said. “With annual inflation now at 19 percent and projected to enter single-digit levels early next year, maintaining a tight stance is necessary to protect the gains already made.”

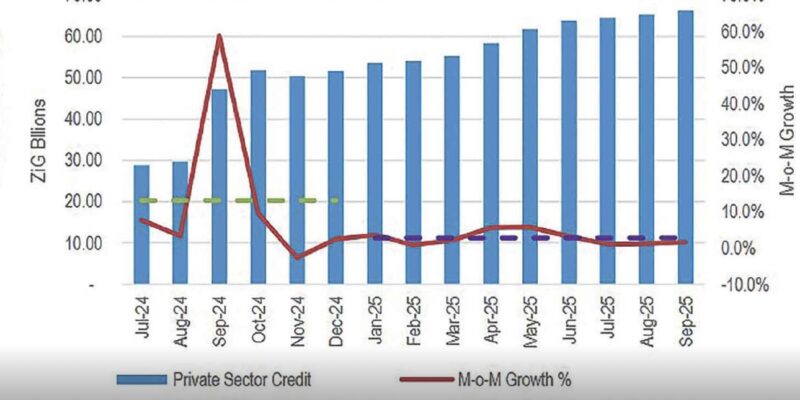

Banker Mr Raymond Madziva said that while policy stability was essential, the prolonged maintenance of high interest rates continued to weigh on credit expansion and private sector borrowing.

“Keeping the (bank) policy rate at 35 percent ensures inflation remains contained, but it also means credit remains expensive for businesses trying to expand,” he said. “There is a delicate balance between defending the currency and supporting productive lending.”

According to the governor, maintaining positive real interest rates remains vital to boosting demand for the ZiG, protecting the value of savings and discouraging speculative borrowing.

On the fiscal side, the MPC welcomed the Government’s decision to reduce the Intermediated Money Transfer Tax (IMTT) on ZiG transactions from 2 percent to 1,5 percent. Dr Mushayavanhu described the measure as supportive of efforts to strengthen domestic currency usage.

“This measure is critical to complement monetary policy measures aimed at promoting the wider use of the domestic currency and financial inclusion,” he said.

He noted that a more attractive transactional environment for ZiG payments is essential as Zimbabwe moves toward the long-term goal of transitioning to a monocurrency by 2030.

Commenting on fiscal adjustments, Mr Madziva said the IMTT reduction was positive but still not sufficient to unlock the full potential of digital payments. “A further gradual reduction in 2026 would help promote formalisation and increase transaction volumes.”

The governor emphasised that sustained foreign currency inflows, now above US$13 billion for the 10 months to October, have strengthened reserves and lifted confidence in the Willing-Buyer Willing-Seller market.

Comments