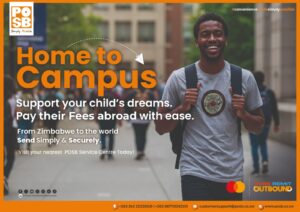

People’s Own Savings Bank (POSB) has partnered with global payments giant Mastercard to introduce an outbound international remittance service, designed to make cross-border transfers faster, more affordable, and more accessible for Zimbabwean customers.

The new platform, known as POSB Remit Outbound, enables users to send money from Zimbabwe to bank accounts, mobile wallets, or cash pick-up points across 21 international destinations, including key markets such as South Africa, the United Kingdom, the United States, Canada, India, Australia, and countries within the SEPA region.

In a statement, POSB Chief Executive Officer Mr. Garainashe Changunda said the bank’s collaboration with Mastercard reinforces a shared commitment to strengthening financial connectivity for Zimbabweans at home and in the diaspora.

“POSB Remit Outbound underscores our strategic collaboration with Mastercard to advance financial connectivity for Zimbabweans,” Changunda said. “By enabling seamless global transactions, we reaffirm our joint commitment to driving convenience, digital inclusion, and innovative payment solutions across borders.”

Mastercard’s Southern Africa Country Manager, Gabriel Swanepoel, highlighted the importance of the partnership in expanding access to secure, transparent, and efficient international payment systems.

“At Mastercard, we are building the infrastructure that powers inclusive global money movement,” Swanepoel said. “By combining Mastercard Move’s innovative money movement solutions and extensive reach with POSB’s trusted local presence, we are enabling Zimbabweans to move money securely and transparently, with the choice and speed they need to thrive in today’s connected economy.”

Powered by Mastercard Move—Mastercard’s global payments infrastructure designed to simplify cross-border payments—the service responds to growing demand from Zimbabweans who support families abroad, fund education, and cover medical expenses.

Low minimum amounts make the service inclusive for a broad segment of customers, with transfers starting from as little as US$5 at any POSB branch nationwide. Funds can be delivered directly to beneficiaries’ bank accounts or mobile wallets or collected as cash at partner payout points abroad.

Industry observers believe this launch positions POSB favorably among local banks seeking to enhance digital financial services and broaden access to international financial networks—a strategic move that aligns with global trends toward easier, cheaper, and more transparent remittance flows.

Comments