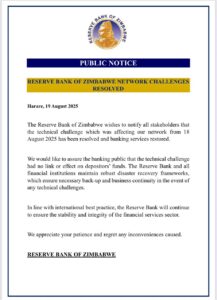

The Reserve Bank of Zimbabwe (RBZ) has successfully resolved a technical network glitch that temporarily disrupted banking services across the country on Sunday, 18 August 2025. In a statement , the central bank confirmed that all affected systems have been restored and digital banking operations are now running normally.

The outage had caused widespread interruptions to transaction processing and limited access to some banking platforms, raising public concern. However, the RBZ moved swiftly to reassure customers that the disruption had no bearing on the safety or security of their funds.“We would like to assure the banking public that the technical challenge had no link or effect on depositors’ funds,” the bank stated.

Highlighting the resilience of the country’s financial infrastructure, the RBZ noted that both the central bank and financial institutions across Zimbabwe operate with robust disaster recovery and business continuity frameworks. These systems are designed to safeguard against unplanned outages and ensure that services can be restored efficiently in the event of any technical failure.

The statement also emphasized that Zimbabwe’s banking sector remains aligned with international standards, particularly in how it responds to system-wide disruptions. The RBZ expressed appreciation for the public’s patience during the downtime and reaffirmed its ongoing commitment to maintaining the stability, security, and integrity of the national financial system.

As Zimbabwe deepens its reliance on digital financial services, the incident serves as a timely reminder of the importance of resilient IT infrastructure and proactive risk management within the banking ecosystem. The swift resolution of the issue reflects not only technical competence but also a broader institutional readiness to manage the challenges of an increasingly digitized economy.

Comments