When Apple’s latest iPhone 17, hit the shelves with a starting price of $1,199, a familiar cycle began. Teardown specialists from various firms meticulously dissected the device, and their findings, an estimated USD$408 in physical components. This inevitably sparks a firestorm of online debate about corporate greed and inflated margins. However, most argue that to fixate on this simplistic parts-to-price comparison is to fundamentally misunderstand the nature of modern innovation and the complex ecosystem that brings a device like the iPhone to life, the real story of the iPhone’s value isn’t found in the sum of its silicon, it’s etched into the invisible architecture of its creation.

While Apple justifies the cost with a narrative of superior engineering and ecosystem, a closer examination reveals a business model where the consumer shoulders the immense burden of its operational bloat and market dominance, what we may call, “The Apple Tax”.

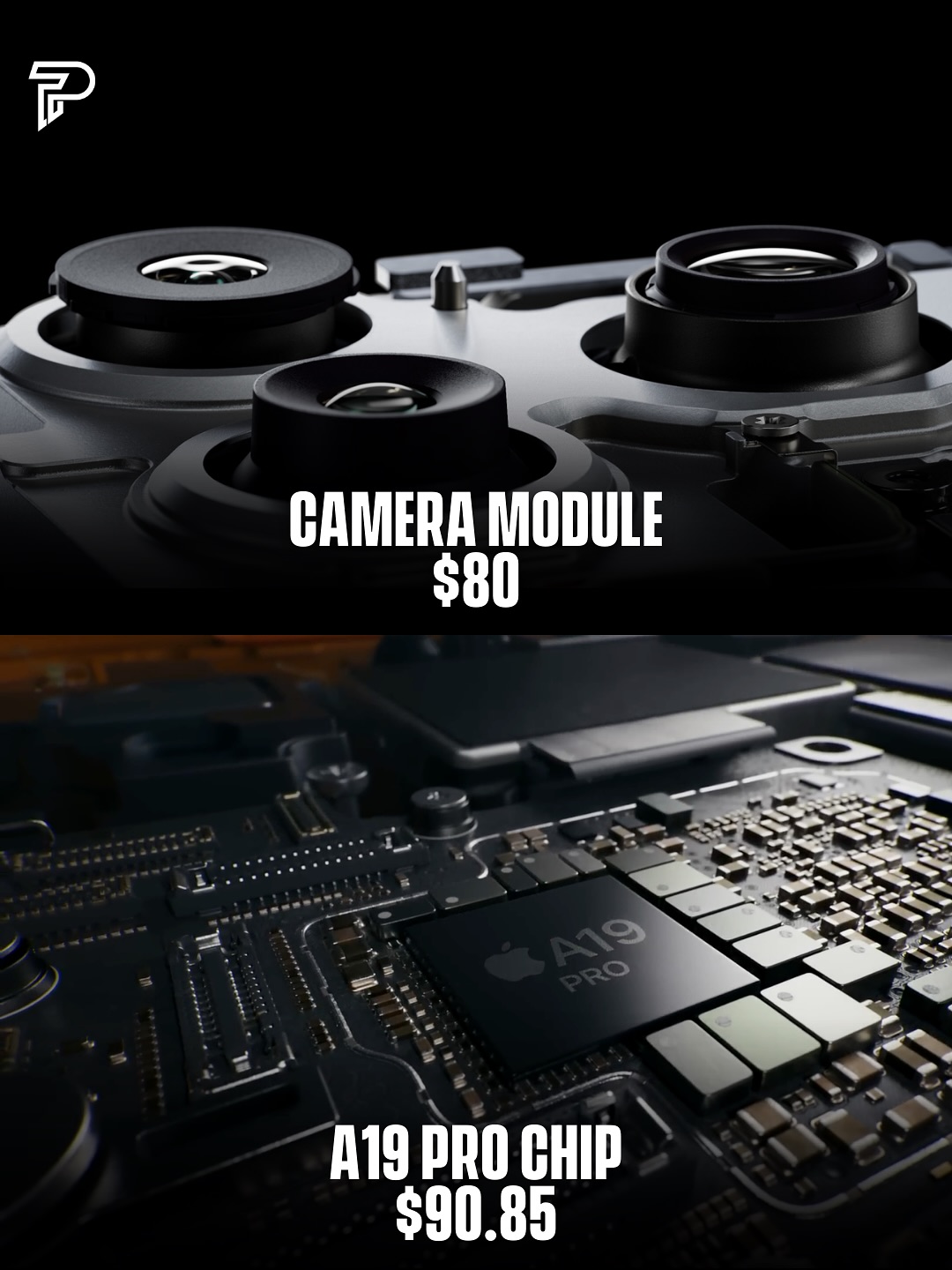

It’s true that the components themselves tell a story of high-end engineering. The camera system (480) ($80), A19 pro chip ($90.85), 256GB storage ($20.59), memory ($21.80), main enclosure ($20.79), battery ($4.10), 5G modem ($90), and premium display are not cheap ($80), they are the crown jewels of the device, accounting for the bulk of that $408 cost. However, to frame these as mere parts is misleading. They are the culmination of years of research and development, and that research and development is the first and most significant cost loaded onto the consumer. The question isn’t whether research and development exists, but whether its scale and the relentless annual upgrade cycle it fuels justifies the premium, especially when competitors often integrate similar technologies at lower price points.

The narrative that the remaining cost covers quality control and seamless software also deserves scrutiny. Apple’s legendary supply chain and microscopic failure rates are a feat of industrial engineering, but they are also a necessity for a brand built on a promise of perfection. The cost of maintaining this reputation, of ensuring that a device produced in the millions has minimal defects is passed directly to the buyer.

Similarly, the sophisticated software of iOS is not a free gift, it is a fundamental part of the product. Its development cost is embedded in the hardware price, creating a walled garden where the entry fee is the phone itself.

A significant portion of the iPhone’s price is also a direct subsidy for Apple’s global empire. The marketing machine that creates cultural phenomena around each launch, the sprawling network of architecturally distinct Apple Stores that serve as physical billboards, and the colossal logistics of a synchronized global release are not just operational expenses they are strategic tools for maintaining market hegemony. The consumer isn’t just buying a phone, they are funding the very apparatus that ensures its desirability and cements Apple’s status as a luxury brand.

This model is fundamentally different from many tech rivals. While companies like Google leverage advertising and services for revenue, Apple remains, at its core, a hardware company. Each iPhone must be profitable enough to sustain the entire enterprise, from the failed projects in its labs to the dividends paid to its shareholders. This hardware tax means that the device in your pocket is carrying the financial weight of Apple’s entire corporate structure.

So, where does this leave the consumer? The value of an iPhone is indeed more than the sum of its parts, but that value is a carefully constructed amalgam of tangible utility and perceived prestige. You are paying for the research and development but also for the marketing that convinces you that research and development was necessary. You are paying for the seamless ecosystem, but also for the lock-in that makes leaving it difficult. The Apple tax is real, but it’s not merely profit it’s the cost of funding a self-perpetuating cycle of innovation, marketing, and brand dominance.

In the end, the $1,199 price tag is a reflection of a business choice, not just an engineering one. Apple has chosen to build the best, most integrated device possible and to charge a price that supports its vast universe of operations and expectations. Whether the intangible benefits of design, brand cachet, and ecosystem cohesion are worth that premium is a calculation every buyer must make for themselves. The components may only cost $408, but the price of admission to the world Apple has built is, and likely will remain, considerably higher.

Comments