By Ross Moyo

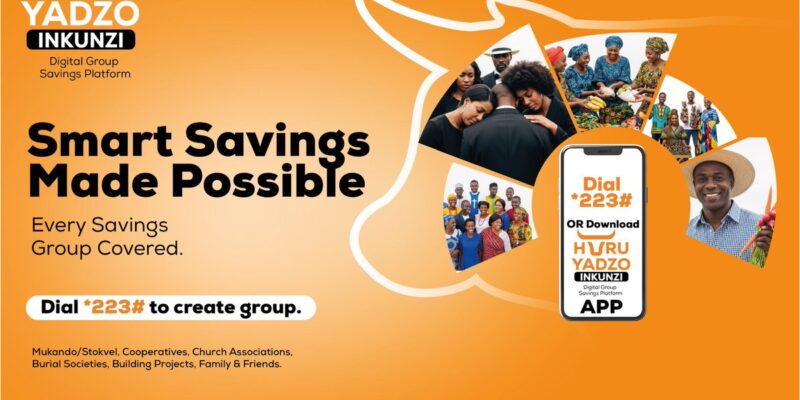

The People’s Own Savings Bank (POSB) has launched Huruyadzo/Inkunzi, a digital mobile-based group savings platform that is expected to revolutionize the way Zimbabweans save and access financial services. With this innovative platform, POSB aims to increase financial inclusion and support the government’s vision of creating an upper-middle income class economy by 2030.

The platform formalises the traditional Mukando savings system, providing a safe and secure way for groups to save and manage their money. “Huruyadzo/Inkunzi is a game-changing innovation designed to protect and strengthen the way Zimbabweans already save together,” said POSB Chief Executive Officer, Garainashe Changunda.

With Huruyadzo/Inkunzi, groups can save and manage their money without the risk of theft or mismanagement. The platform is accessible to anyone with a mobile phone, without the need for a smartphone or internet access. “What makes Huruyadzo truly transformational is its accessibility,” said Changunda.

The platform is expected to support financial inclusion by offering safe savings to both the unbanked and underbanked, including informal traders, civil servants, churches, burial societies, farmers, savings clubs, and other community groups. “At POSB, financial inclusion is not a slogan. It is our mandate,” said Changunda.

Huruyadzo/Inkunzi is a major step towards bringing safe and inclusive financial services to everyone in Zimbabwe. The platform is part of POSB’s transformation agenda, which aims to shift the Bank from being product-centric to customer-centric.

The launch of Huruyadzo/Inkunzi is expected to increase POSB’s customer base and support the Bank’s goal of becoming a leading digital and AI-powered financial institution in Zimbabwe. “We are formalising Mukando in a secure and transparent manner so that no individual can spend or put the group’s hard-earned savings at risk without the knowledge and approval of other members,” said Changunda.

Zimbabweans are invited to try Huruyadzo/Inkunzi by dialling *223# and starting their group savings journey today. The platform is expected to make a significant impact on the country’s financial inclusion landscape and support the government’s vision of creating an upper-middle income class economy by 2030.

Comments