Zimbabweans are set to pay more for everyday digital services after banks quietly adjusted charges on international online transactions, a move that reflects the Government’s latest push to tax offshore digital platforms. From streaming and AI tools to satellite internet and ride-hailing apps, the cost of staying connected to the global digital economy is about to rise.

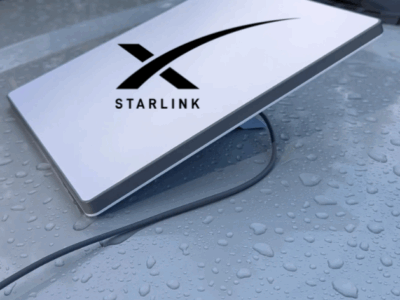

Bank alerts sent to customers indicate that, starting 5 January 2026, fees on Visa international POS and e-commerce transactions will increase from 1 percent to 2.2 percent per transaction. The change also introduces additional charges on failed or declined payments, meaning users may now incur costs even when transactions do not go through. For consumers who rely on services such as ChatGPT, Netflix, Starlink, Grammarly, Spotify and various e-hailing platforms, the impact will be immediate and unavoidable.

The fee hike is closely linked to Treasury’s decision to introduce a 15 percent Digital Services Withholding Tax on payments made to offshore digital platforms, effective 1 January 2026. The tax targets foreign companies that earn revenue from Zimbabwean users without a physical presence in the country, a practice authorities say has long gone largely untaxed despite significant capital outflows.

Most digital subscriptions and online services in Zimbabwe are paid for in foreign currency, with funds flowing directly outside the country. Government argues that this has given international platforms an unfair advantage over local businesses, while steadily eroding national revenue. By enforcing a withholding tax at the point of payment, authorities aim to close this gap and bring the digital economy into the tax net.

Under the new system, banks and mobile money platforms will automatically deduct the tax when users make payments to offshore services. While customers will not pay the tax as a separate line item, it will be embedded in higher transaction charges, a reality already reflected in recent bank notifications. In effect, the burden shifts directly to consumers through increased subscription and payment costs.

For ordinary users, the result is a more expensive digital lifestyle, with higher monthly subscriptions, costlier once-off online payments and penalties on failed transactions. For local media houses, online publishers and content creators, the situation highlights a deeper imbalance. While the State is moving swiftly to tax global digital giants, many local digital players continue to struggle to monetise their content and earn sustainable incomes within the same ecosystem.

As Zimbabwe tightens its grip on the digital economy, the policy signals a clear intention to assert fiscal control over cross-border digital trade. However, it also raises critical questions about affordability, access and the long-term impact on digital adoption in a market where online tools are increasingly essential for education, business and innovation.

Comments