THE Reserve Bank of Zimbabwe (RBZ) should open the procurement of Point-of-Sale (POS) machines to private players since banks have failed to meet the demand, the Confederation of Zimbabwe Retailers (CZR) has said. The country has witnessed an upsurge in the use of plastic money due to the cash crisis.

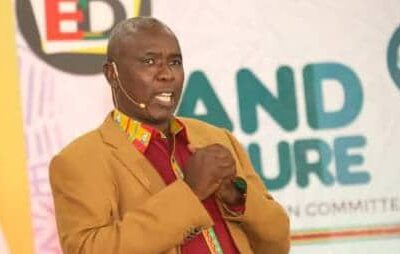

POS transactions are made through using plastic cards issued from banks, which include Visa, MasterCard or locally-issued debit cards. In an interview with NewsDay, CZR president Denford Mutashu said the RBZ should be applauded for supplying the market with 40 600 POS machines so far and his association was hopeful that the figure may increase significantly if the RBZ imports the machines on behalf of the market.

“Initially, the CZR is looking at a target of 100 000 machines before the end of the year and maybe its high time the RBZ even open the procurement of the POS machines to private players since banks have failed to meet the demand,” Mutashu said.

RBZ governor John Mangudya is on record saying that 75% of transactions were plastic money and 25% cash in the formal sector, while in the informal sector 75% transactions was cash and 25% plastic money.

Retailers have reported a 75% increase in the use of plastic money since the cash shortages started last year.

Mutashu said the rural retailers have also borne the brunt of the liquidity situation in the country, urging the RBZ to ensure that cash allocations were increased to rural banks.

He said there was need to register all traders in the country and business should stop trading in foreign currency and resort to their core activities.

POS payments have been on an upward trend since March when Mangudya stated that the lender of last resort would be aiming to have an 80% cashless society by 2020.

A few months ago, the RBZ reduced bank charges on electronic transactions in an ambitious drive to promote plastic money transactions. NewsDay

Comments