Government is considering introducing measures that would protect financial technology (fintech) depositors which will benefit consumers while fostering financial inclusion, The Chronicle has reported.

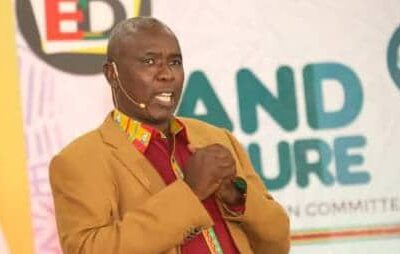

According to The Chronicle, the perspective was made by Finance and Economic Development Minister, Dr Ignatius Chombo at the International Association of Deposit Insurers conference in Victoria Falls on Monday.

In a speech read on his behalf by his principal director Mr Pfungwa Kunaka, Dr Chombo called for the regulation of digital financial services. “There has been a phenomenal growth in digital financial services and products in Africa especially those linked to mobile money services.

“Expanding access to financial technology linked deposits requires introduction of basic protections for the clients of financial services,” he said.

The minister’s sentiments come at a time when the Zimbabweans have embraced mobile money with Econet and NetOne — the two biggest players in the telecommunication sector — introducing new products to entice the market. NetOne recently introduced an innovative mobile financial service product called OneMoney, which can be linked to a ZimSwitch enabled debit card and can transfer money from Wallet to the bank or Zipit to Wallet and so forth.

Given the prevailing cash shortages in the economy, more people are increasingly using mobile money and other electronic transactions like swiping.

Econet has also launched a new mobile money service that enables customers to swipe with any ZimSwitch enabled cards via Steward Point of sale machines dubbed Swipe-into-EcoCash.

The innovative service allows EcoCash registered customers with ZimSwitch-enabled cards to swipe when making payments. As such, Dr Chombo encouraged deposit protection schemes to keep abreast with the evolving developments in financial technology linked products.

“It is noted that consumer protection in the financial sector has continued to gain prominence since the Global Financial Crisis of 2007 to 2009. Thus, it is imperative that Deposit Protection Schemes and other financial safety net players, keep themselves abreast with rapidly evolving developments in financial technology (fintech) linked products; and find innovative ways to extend protection to consumers of such products.”

Dr Chombo said financial regulators and researchers the world over were working flat out to find ways to regulate and offer protection to consumers and providers of fintech linked products as well as enhance financial stability.

The two-day conference, which started on Monday and ended yesterday, ran under the theme “deposit protection and financial technology linked deposits”.

The event was attended by the Deputy Governor of the Reserve Bank of Zimbabwe, Dr Jesimen Chipika, (IADI) secretary general, Mr David Walker, IADI and Deposit Protection Corporation chief executive officer and managing director, Mr John Chikura, Bankers’ Association of Zimbabwe representatives as well as board of directors of the Deposit Protection Corporation.

According to latest figures from RBZ, mobile money transactions reached $11 billion

Comments