Mobile payments platforms are getting a lot of traction around the world. With over 66% of the world population having effected a payment using mobile means worldwide, they have become a permanent payment option. Here in Zimbabwe, they are just as popular, and that popularity presents an opportunity for tech start ups.

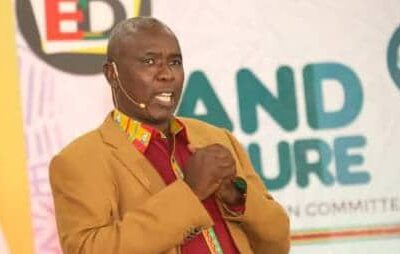

A Bulawayo based developer expressed an interest in creating mobile money platform At the moment, they have created an app, PayEasy to add more convenience to EcoCash. The lead developer Bheki Ncube once spoke to TechnoMag about PayEasy and their intentions to expand into mobile money platforms.

By Pearson Mbendera

“We are yet to expand to mobile money platforms, but that’s the goal. We would love to own our own system that keeps people’s money but the idea is a bit demanding in terms of legal and financial requirements, but we would like to go down that direction given the resources.” said Ncube.

At the moment, the market is dominated by mobile network services providers, with EcoCash controling 98% percent of the market. But there is always room for more players.

There is a lot of convenience but the services do not necessarily permit for an ease of use without the proper You cannot join Telecash or OneMoney while on an Econet line and they cannot do the same on EcoCash. This simply highlights the challenges the people face with mobile money services in Zimbabwe. Its not the same as just downloading an app, something that can be done

With RBZ already researching on Bitcoin, the time for technology backed payment system is today and it will only grow bigger, creating a lot of opportunities for technology start ups.

There are a lot of start ups out there creating mobile money platforms that are delivering better than what mobile services providers have created and some, like SpazaApp, a mobile payment platform in South Africa found a niche in catering for the informal traders and convenience stores, better known as spaza shops, in South Africa.

Sure, there are a lot of considerations with regards to money and other issues, but the major goal is coming up with a well working mobile money platform that offers a lot of convenience and integrates well with other financial services.

A lot of developers in Zimbabwe have created apps to aid in the service delivery of existing mobile money platforms like Ecocash. But that shouldn’t be the only thing that start ups and developers here in Zimbabwe get to do, simply improve the workability of other platforms but actually challenge them as they have already discovered some weaknesses in those platforms.

There are a lot of opportunities in a country like this, considering the cash shortages we are facing at the moment. It will also be a welcoming relief, seeing start ups battling it up with established players in providing mobile money services. One thing is for sure, the Zimbabwean populace will benefit immensely from it.

Comments