When Zimbabwe introduced the Zimbabwe Gold (ZiG) currency in 2024, it was presented as a revolutionary monetary instrument, one backed by gold reserves, promising stability and a safeguard against inflation. The Reserve Bank of Zimbabwe (RBZ) assured the nation that this asset-backed currency would restore confidence in the financial system. However, just over a year later, the country has shifted course, now allowing market forces to determine the exchange rate under the *Willing Buyer, Willing Seller (WBWS) system*.

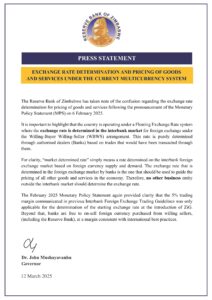

In a statement this week, the RBZ clarified that it no longer controls the exchange rate, instead leaving it to be set by banks in the interbank market. This move, which comes after months of relative currency stability, signals a major shift in monetary policy one that effectively replaces the gold-backed premise with a floating exchange rate dictated by supply and demand. Analysts have noted that this change has reduced distortions in the forex market, narrowing the gap between official and parallel rates. Economist Malone Gwadu pointed out that the system allows holders of foreign currency to set prices freely through banks, moving away from fixed-rate interventions by the central bank.

While this approach aligns with global financial norms, it raises questions about whether ZiG still retains its gold-backing or has quietly transitioned into a conventional fiat currency. If the currency were truly pegged to gold, its value would be more resistant to market fluctuations. Instead, the decision to fully liberalize the exchange rate suggests that the market not Zimbabwe’s gold reserves is now the primary force behind the currency’s value. Financial analysts argue that this was a necessary shift, considering the country’s troubled history with fixed exchange rate regimes, which often led to forex shortages and rampant parallel market activity.

Yet, the move is not without risks. By fully floating the currency, Zimbabwe is exposing ZiG to the same market dynamics that have previously led to volatility and rapid devaluation. If foreign currency inflows decline or economic confidence wavers, the currency could face significant pressure, leading to inflationary spikes. Economic commentator Persistence Gwanyanya emphasized that banks must ensure that their exchange rate margins follow international best practices to prevent market manipulation and speculation.

The RBZ’s statement also raises concerns over the transparency of Zimbabwe’s monetary policy. If gold reserves are still backing ZiG, the central bank must provide clarity on how they influence the exchange rate in this new system. Otherwise, the public is left to assume that Zimbabwe has quietly abandoned its gold-backed model in favor of a fully floating fiat currency. The implications of this shift will be far-reaching, affecting everything from pricing stability to investor confidence in the long term.

For ordinary Zimbabweans, this policy shift means that their purchasing power now rests on market sentiment rather than a fixed asset backing. While the central bank’s decision to let market forces dictate the exchange rate has brought short-term stability, questions remain about the long-term sustainability of this approach. If fundamentals weaken, Zimbabwe could once again find itself battling currency volatility. The government may have taken a bold step in allowing market forces to take charge, but whether this strategy will deliver the promised economic stability remains to be seen.

Comments